DMC

October 6, 2025

Categories:

DMC

Hogs

- Lean hog futures ended the week with some strength across all the contract months. For the week lean hogs moved lower with front month October down over $2.50 while deferred months such as June took off a bit less than $2.

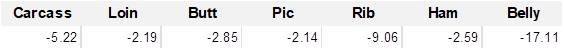

- Cutout was supportive on Friday posting 95 cents higher. Gains in cuts struggling earlier in the week were able to push the overall value higher on Friday. Week to date cutout gave up $5.22

- Cash was slightly lower on Friday, with the national down 20 cents. Slaughter was estimated at 2,602, just above last week, and just shy of last year at this time. Stronger slaughter this week as levels since July were running around 1.9% below last year. While cash struggled last week, it seemed packers were able to acquire their needs.

- The Commitments of Traders report was not released due to the government shutdown.

- Cash isowean pig prices for the week ending 10/3 averaged $64.34,up from last week $60.97 and last year $42.02.

Grains

- This morning Dec corn is unch at 4.19. Nov beans are up 2 at 10.20. Equities are higher, and crude oil is higher. Gold is higher to start the morning. The USD is higher at 98.29.

- Upcoming U.S.–China trade talks are expected to yield meaningful progress. Treasury Secretary Scott Bessent indicated that the next round of negotiations could lead to a breakthrough, potentially resolving the ongoing soybean dispute. The discussions will take place later this month when President Trump meets with Chinese President Xi Jinping in South Korea.

- Amid the prolonged trade war, China has increased its soybean imports from South America, reducing its reliance on U.S. supplies and using the ban on American soybeans as leverage in negotiations. In response, President Trump is expected to unveil a new aid package this week aimed at supporting farmers—particularly soybean producers—affected by the trade conflict.

- Bitcoin surged to a new all-time high over the weekend, climbing as high as $125,689 on Sunday and surpassing its previous peak from mid-August. The rally was fueled by gains in equity markets and renewed inflows into Bitcoin-linked ETFs.

- Investors are viewing the potential government shutdown as a driver of safe-haven demand, turning to Bitcoin in what many are calling a “debasement trade.” Further supporting bullish sentiment, October has historically been a favorable month for Bitcoin, with gains recorded in nine of the past ten years. So far in 2025, the cryptocurrency is up approximately 31% year-to-date.

- The government shutdown is expected to extend into this week after the Senate failed on Friday to pass either the Republican or Democratic funding proposals. The GOP plan would have funded the government through November 21, while the Democratic measure sought an extension through October and included a renewal of health care tax credits.

- In an effort to increase pressure on the Senate, House Speaker Mike Johnson canceled the House’s planned return this week. The shutdown has already led to significant disruptions, with roughly half of USDA employees furloughed, halting certain agency reports and delaying data collection efforts.

Cattle

- Live cattle futures closed higher on Friday. For the week October gave up 78 cents, while deferred months were able to hold it together with slight gains week over week. For now the concern that the market is near a top seems to be on the trades mind more than tight supplies. Feeder cattle prices at auctions traded mixed last week, but held strong.

- Cattle sold in the north last week from $229-$230 live and dressed from $359-$360. Meanwhile Kansas and Texas cattle sold late week mainly at $233 slightly lower. Recent weeks have watched cash prices in the north move from $244 to $230 while southern live prices have moved from $240 down to $233 this past week.

- Cargill announced closing of their Ft. Morgan plant effective October 3, for 10 days to complete upgrade work.

- Slaughter for the week estimated at 555,000, down again from last year around 9%. Seasonal weakness this time of year is typical yet some nervousness has crept in as packers find themselves in command as a buyer for a change. The packer owns quite a few cattle with time and plenty of forward contracts so can afford to be patient.

- Boxed beef values closed mixed on Friday. For the week choice gave up $9.16, with select -$7.06.

- The Commitments of Traders report was not released due to the government shutdown.

Weather

- Rains are moving from northwest to southeast across the corn belt this morning, with mostly light amounts expected in the heart of the Midwest; heavier action is seen in the Ohio River Valley tomorrow before a drier stretch settles back in past that, later this week into the weekend. Above-normal precipitation is present in the extended forecasts, but it chiefly hangs out in the far west with the bulk of the belt dry for harvest. Temperatures will finally cool a bit this week but the outlook remains warm right up into late October.

- Brazilian rains held far south over the weekend, shifting up into the center east this work week; better chances are present center-north now for the 6-10 day time frame, aiding moisture for planting as fieldwork spreads northward.

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.