DMC

August 15, 2025

Categories:

DMC

Hogs

- Lean hog futures were lower on Thursday falling below technical support for the day. Futures have struggled the past 3 days.

- Pork cutout was not supportive on Thursday as well, falling $1.32 with a mixture in cuts. Bellies have been in tighter in some areas and more available in some. Demand at retail level has also been mixed. Butts were a bit tighter seeing some export interest.

- Exports from yesterday. Pork: Net sales of 21,200 MT for 2025 were down 32 percent from the previous week and 19 percent from the prior 4-week average. Increases primarily for Japan (6,500 MT, including decreases of 100 MT), Mexico (4,700 MT, including decreases of 600 MT), South Korea (3,500 MT, including decreases of 100 MT), Colombia (1,700 MT, including 100 MT switched from Guatemala and decreases of 100 MT), and Honduras (1,200 MT), were offset by reductions for Hong Kong (100 MT).

- The national price on Thursday came in down slightly 11 cents.

- October will quickly become the front month with a large discount to the current market.

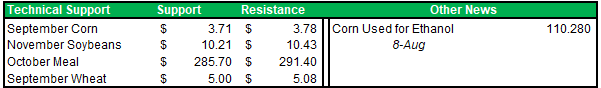

Grains

- Dec corn is up 3 1/2. November beans are up 7 1/4 cents. The equities are slightly higher. Gold is higher, and copper is lower.

- China is securing large volumes of Brazilian soybeans for shipment during the U.S.’s usual export season. For September and October deliveries, Chinese buyers have locked in over 12 million tons from South America, leaving little demand for U.S. supplies. Ongoing trade tensions and a 23% tariff on American soybeans make them less competitive, even though—before tariffs—they are about $40 per ton cheaper. This trend could cost U.S. exporters billions in lost sales and keep prices hovering near five-year lows. Analysts note the U.S. might only ship small volumes late in the season if Brazil’s supply tightens. Last year, China purchased more than 22 million tons of U.S. soybeans, but volumes have plunged since the trade war began. If a tariff-reduction agreement is reached later this year, U.S. soybeans could regain competitiveness against Brazilian exports.

- New crop U.S. corn export sales remained exceptionally strong last week, with weekly net bookings of 2.05 MMT (81 million bushels) reaching historically high levels despite limited buying from China. Sales were 156% higher than the same week last year, with Mexico leading purchases.

- New crop soybean sales also outperformed pre-report expectations, totaling 1.1 MMT (42 million bushels), led by “unknown destinations” as the top buyer. China has yet to commit to any new crop U.S. soybeans.

- Wheat sales were solid at 722,800 MT (27 million bushels) — down 2% from the previous week but 14% above the prior 4-week average. South Korea was the largest buyer during the period.

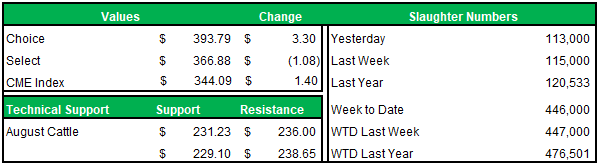

Cattle

- Cattle futures struggle on Thursday with extreme volatility yet closing above the lows for the day. The nervousness is seen in the complex. USDA Secretary Rollins will hold a press conference tomorrow in Austin, Texas to announce an update on the agency’s fight against New World Screwworm. It’s rumored that part of her comments will announce a plan for reopening the border to the importation of Mexican feeder cattle from Mexico into the U.S..

- Cash prices developed a much larger trading range as futures tanked. Packers were more than ready to drop bids as futures fell. Nebraska held most prices at $245 live and $385 dressed but Iowa price range was from $240-$245. Trading mostly stopped in the south as packers pulled bids back to $233 and found no takers.

- Cutout was mixed with choice up another $3, so far tight supplies and consumer demand have pushed values near the summer highs. Demand for end cuts to hit the grinder is partially responsible for the extra strength along with sharply reduced throughput.

- Even if there is an announcement of the border reopening, it will have a limited impact on the volume of cattle available to the market.

Weather

- The Plains and corn belt were mostly dry yesterday without the heavy north-ern rains that were expected; rains are seen lingering in the north today through early next week, finally shifting out to the northeastern belt by around next Tuesday. Forecasts look drier past that, with precipitation chances mostly holding out to the western U.S for the 6-10 and 11-15 day time frames. Temperatures are seen holding safely above-normal into the end of August, though with no extreme heat on tap.

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.