DMC

February 2, 2026

Categories:

DMC

Hogs

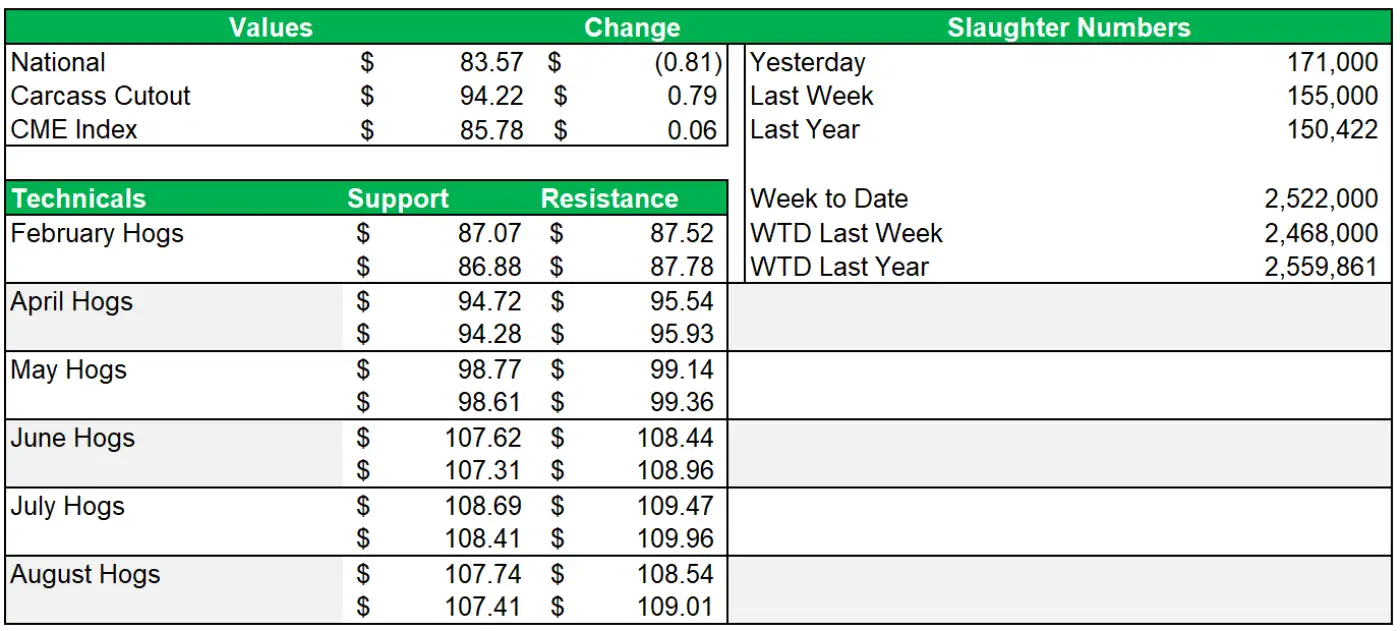

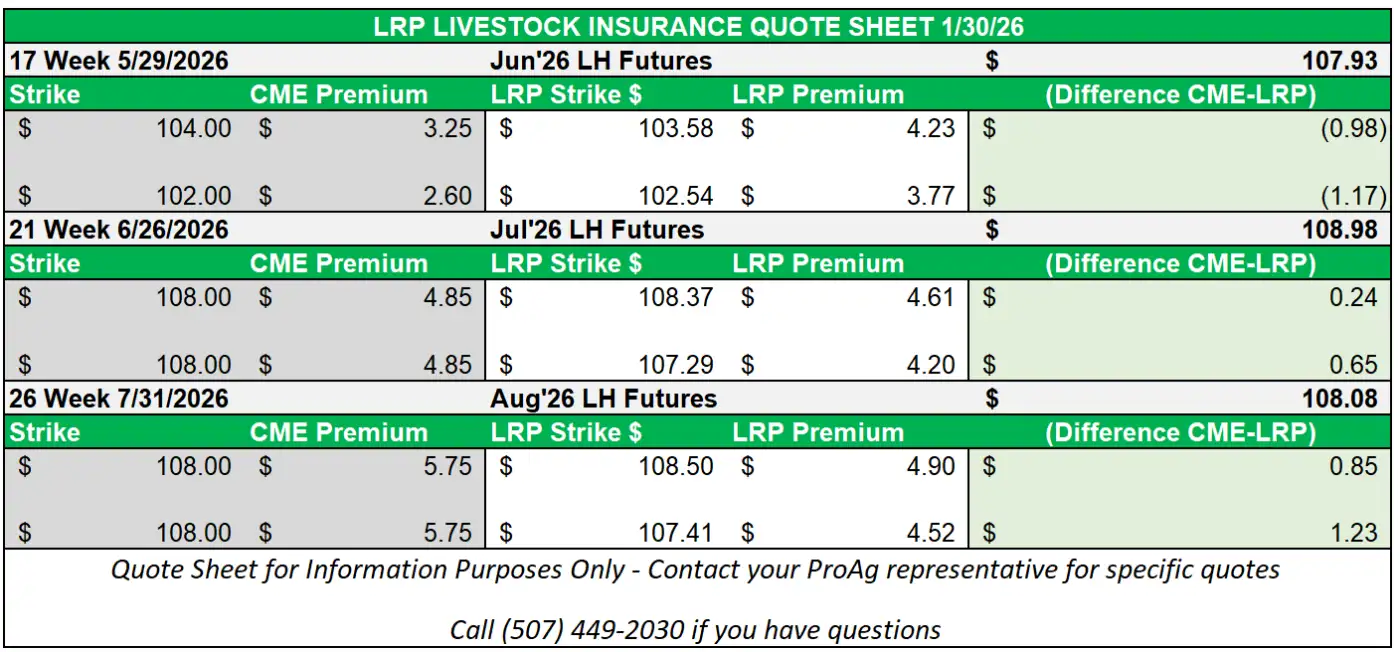

- Front-end lean hog futures closed lower on Friday losing overall on the week, while the August and later contracts were higher on the week. The February contract settled at $87.25 on Friday down $1.10 from last Friday. Stalling gains in the cutout and negotiated hog markets are eroding some of the momentum in the rally that began in November. The Apr-Jul contracts lost $0.20 to $1.02 on the week, while the Aug-Dec gained $0.20 to $0.80.

- The negotiated national average finished the week lower at $83.57, down $0.81 on Friday afternoon.

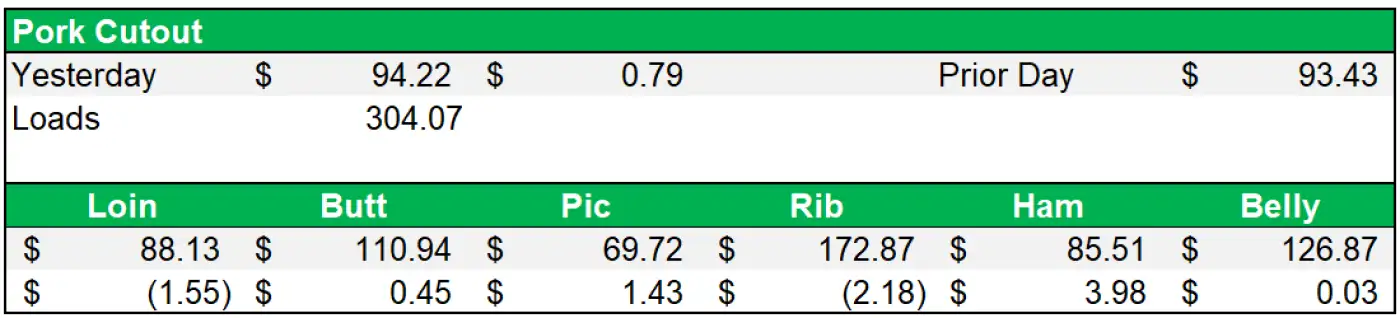

- The pork cutout was higher on Friday afternoon at $94.22, up $0.79. The cutout has remained rangebound and traded sideways for most of January.

February 26 Hogs

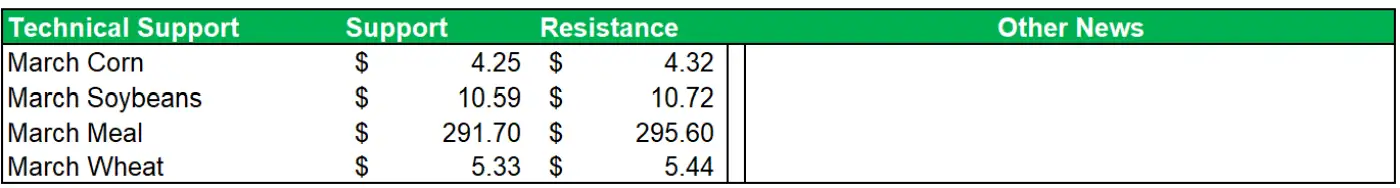

Grains

- Grains were lower on Friday following most commodities in what was generally a risk off day to finish the week.

- In corn futures the front month March was down $0.025 at $4.2825, and the May-Sep months were $0.0325 to $0.0375 lower.

- March soybeans finished at $10.6425, down $0.08 on Friday while the May-Sep contracts were down $0.0875 to $0.0925.

March 26 Corn

March 26 Soybeans

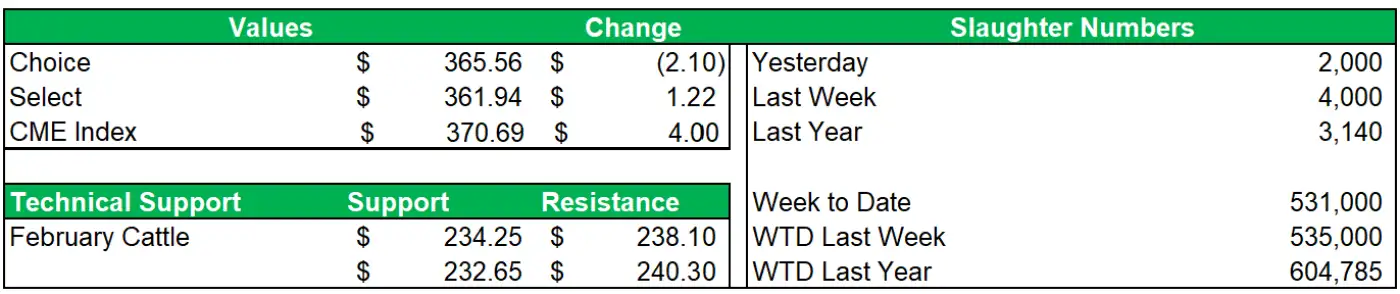

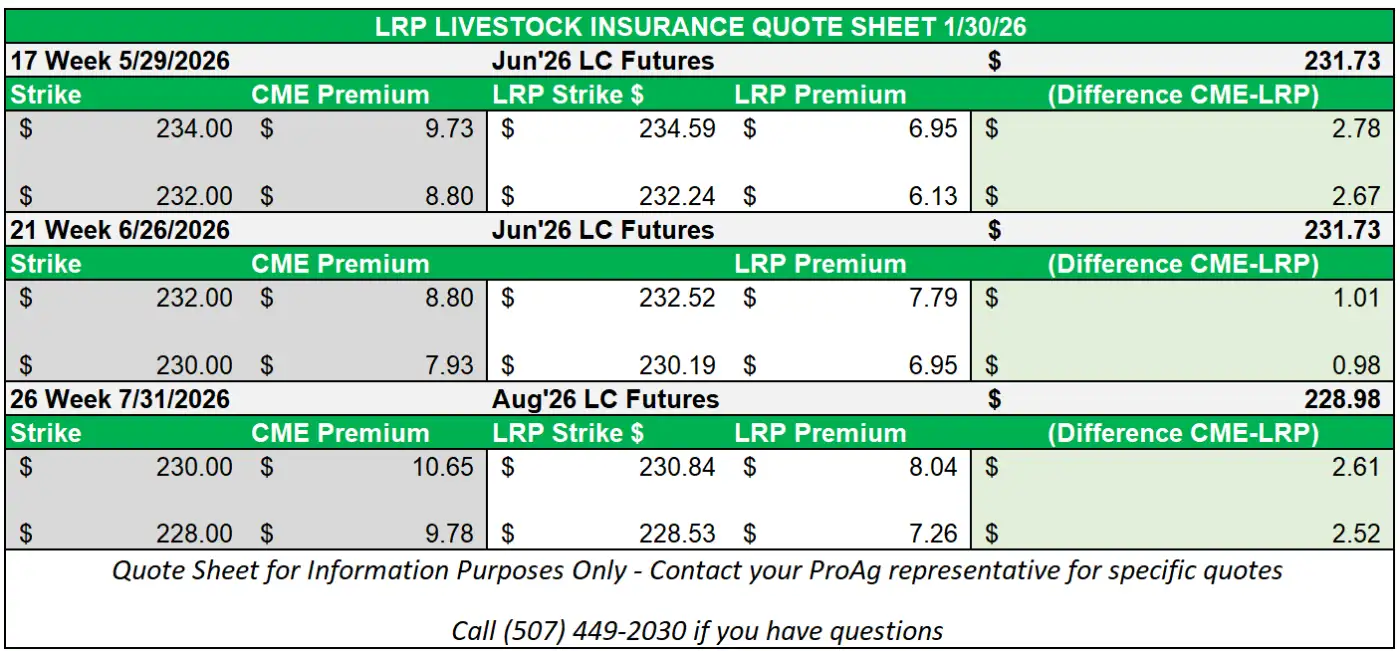

Cattle

- Cattle futures shrugged off the strong negotiated trade that took place on Friday with all contracts but the Feb finishing lower on the day and week. The divergence lower in futures with the stronger cash trade is generally considered a weakening market indicator. Front month Feb settled at $235.85 on Friday, up $0.35 on the day, and up $0.95 on the week. The Apr-Oct contracts were down $0.125 to $1.125 on the week.

- The USDA released their semiannual cattle inventory report today containing the following:

- Total cattle inventory came in at 86.2 million hd, or 99.6% of 2025 vs the pre-report estimate of 99.7%.

- Beef cow inventory was 27.6 million hd, or 99.0% of 2025 vs the pre-report estimate of 100.4%.

- The 2025 calf crop was reported at 32.9 million hd or 98.4% of the previous year vs pre-report estimate of 99.3%.

- Total estimated slaughter for the week was 531K making this the lowest non-holiday weekly harvest since the height of Covid related slowdowns in May 2020.

- Negotiated trade was mostly $238-240, up $3-5 from last week’s averages.

- Boxed beef finished the week mixed with choice down $2.10 at $365.56, and the select up $1.22 at $361.94.

February 26 Cattle

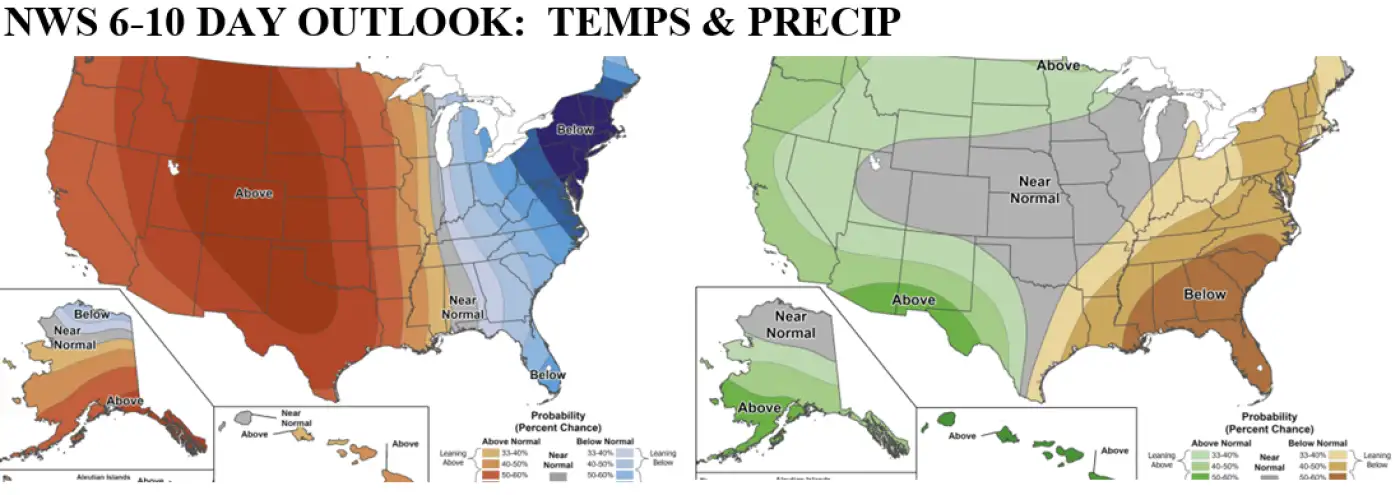

Weather

- The Plains and Midwest were dry over the weekend and remain so this week; extended maps show some better action moving into the far northwest in the 6-10 day period, then the northern Plains and NW belt for the 11-15 day. Temps will be mostly above-normal going forward as warmer weather continues to push in from west to east.

- Argentine rains held far west over the weekend and the best chances remain there over the next ten days, though central and western crop areas will see a rain chance later this week as action briefly pushes into the heart of the belt.

- Brazil saw good weekend rains center-north and that same overall pattern will continue for the next week-plus, while dryness increases in Rio Grande do Sul