DMC

August 18, 2025

Categories:

DMC

Hogs

- Lean hog futures were higher on Friday after a huge bump in the morning cutout. There were gains ranging from $.975 to $1.40 in the deferred.

- Pork cutout ended the day being higher up to $116.40. Only cuts there was a loss in was the belly and the pic.

- The funds added to their long position in the hog market by 1,446 and stand at a total of 110,732 long for MM position.

- As of August 13, the CME Lean Hog Index stood at 109.83, up 0.05 on the day but down 0.27 from the previous week. USDA estimated hog slaughter at 469,000 head on Friday and 35,000 head on Saturday, bringing the weekly total to 2.417 million head. That’s an increase from 2.350 million the week before, but below the 2.516 million recorded a year earlier.

- U.S. pork production for the week ending August 16 was estimated at 507.7 million pounds, compared with 495.1 million pounds the prior week and 527.1 million pounds a year ago.

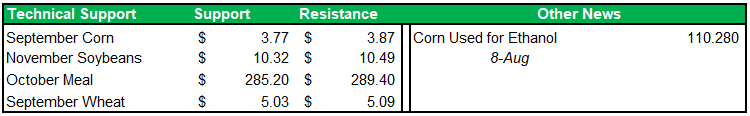

Grains

- Dec corn is down 2 1/4. November beans are down 4 1/2. The equities are mixed. Gold is higher, and copper is lower.

- The December 2025 corn contract ended last week little changed, despite a sharply bearish USDA report. On Tuesday, the USDA pegged this year’s U.S. corn crop at an enormous 16.7 billion bushels—over 700 million bushels above the average trade estimate. Futures briefly dropped to $3.92 per bushel on report day before rebounding to close the week near $4.05.

- Export demand for U.S. corn remains strong, though some uncertainty lingers around the crop. While large harvest projections often expand further with the USDA’s August update, history shows there are notable exceptions.

- The National Oilseed Processors Association (NOPA) reported record July crush data on Friday. U.S. soybean processors handled 195.69 million bushels in July—up 5.6% from June and 7% higher than a year ago. This marked the largest July crush on record and the fifth-largest for any month ever. The figure also topped the average trade estimate of 191.59 million bushels by a wide margin.

- Soybean oil stocks at the end of July slipped to 1.379 billion pounds, down 0.4% from June and 8% lower than last year. Inventories were the smallest for the month of July since 2004 and came in just under the average trade expectation of 1.380 billion pounds.

- The latest CFTC Commitment of Traders report, released Friday, showed funds extended their net short in corn during the week ending August 12. Large money managers were net sellers of 6,000 corn contracts, while adding 27,000 contracts to their net long in soybeans. In SRW wheat, funds reduced exposure, selling 9,000 contracts on the week.

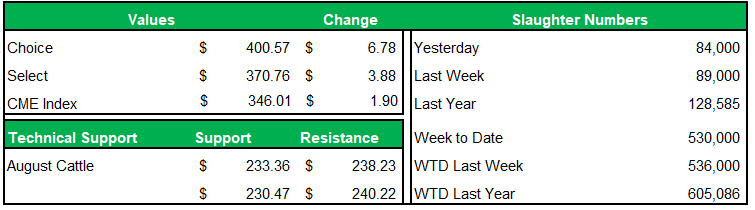

Cattle

- Cattle and feeder markets saw another volatile session, finishing sharply higher on strong cutout values and USDA’s midday press conference on New World screwworm. USDA announced plans to build a permanent sterile fly facility on the U.S. side of the Texas border and will allocate additional funds for research into combating the pest. Market speculation about a possible reopening of the Mexican border proved incorrect, as Secretary Rollins confirmed the border will remain closed until screwworm is pushed further south into Mexico.

- The cattle market has been trading in a high consolidation range for several sessions. Historically, similar periods have often led to a resumption of the broader uptrend. Traders are watching Monday’s lows in December live cattle at 225.92 as a key level—any breakdown could signal weakening momentum. Until then, the uptrend remains intact.

- USDA estimated cattle slaughter at 82,000 head on Friday and 2,000 head on Saturday, bringing the weekly total to 530,000 head. This was down from 536,000 the prior week and well below 605,086 a year ago. The average dressed cattle weight for the week ending August 16 was 865 pounds—steady with the previous week and above 852 a year earlier. For comparison, the five-year average for this week is 830 pounds.

- Beef production totaled 457.6 million pounds last week, down from 514.8 million pounds a year ago. USDA’s boxed beef cutout gained sharply, rising $6.02 at midday Friday and closing $6.78 higher at $400.57. That compares with $378.84 the prior week. The recent low was $393.79 on August 14, while the last high was $401.81 on May 21, 2020.

Weather

- Weekend rains were heavy and widespread in the northern corn belt as expected, stretching down into northern IL as well, with action continuing in the north this morning and moving southeastward through mid-week. Another similar pattern will re-emerge later this week for solid coverage overall through the next five days. Extended maps continue to run a bit drier, holding the main precip chances out to the western U.S. This week will mostly still be a warm one for the Midwest but cooler weather is on the way starting during the 6-10 day this coming weekend, holding normal or below throughout.

About the Author

Jayden Houselog

Jayden brings a unique blend of academic knowledge and real-world farming experience to his role at Professional Ag Marketing. He is dedicated to helping producers navigate complex decisions within their operations by providing honest, data-driven insights and personalized risk management strategies.