DMC

February 5, 2026

Categories:

DMC

HOgs

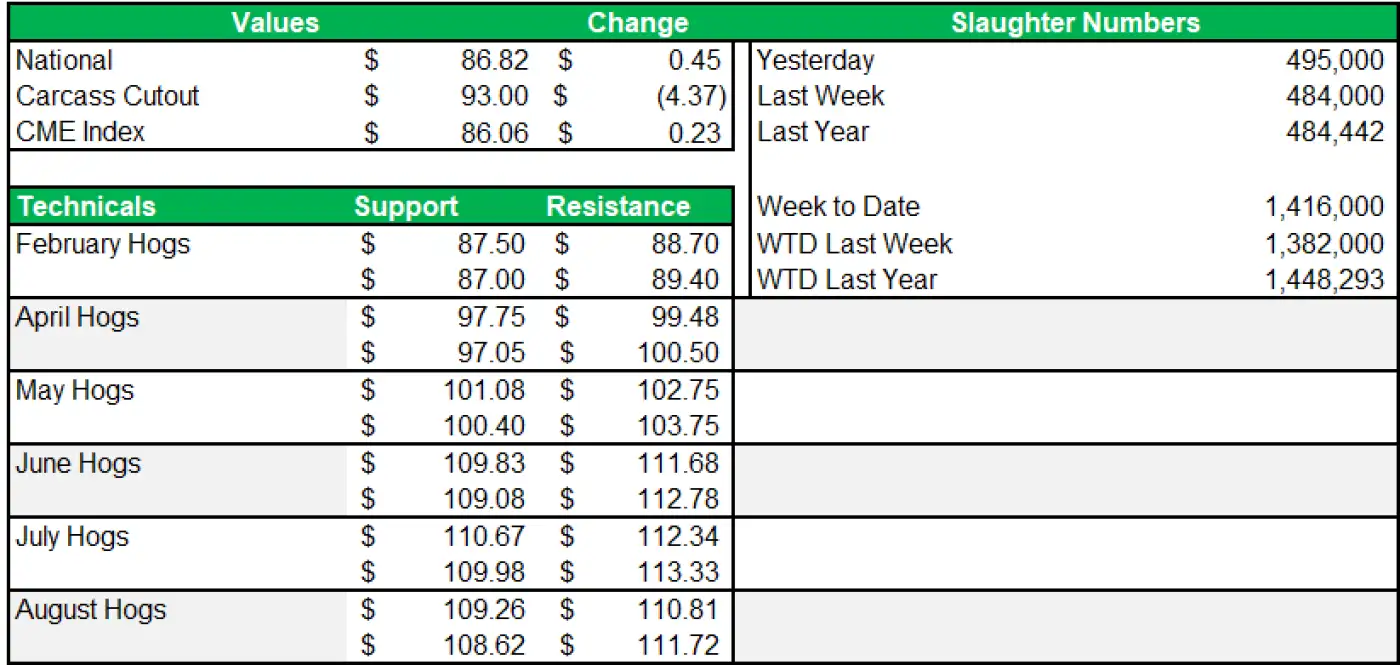

- Yesterday April hogs opened steady but quickly pushed to another new contract high before backing off and ending the day slightly higher.

- Fresh fund buying hadn’t slowed down all week, and open interest kept climbing. Cash hogs were strong as well, up more than $4.00 on Tuesday, marking a new high for 2026.

- The continued rise in open interest suggested there was still room for more upside. Even so, traders needed to keep in mind that the market hadn’t had any real pullbacks since the run began, and a correction was overdue and could show up at any time.

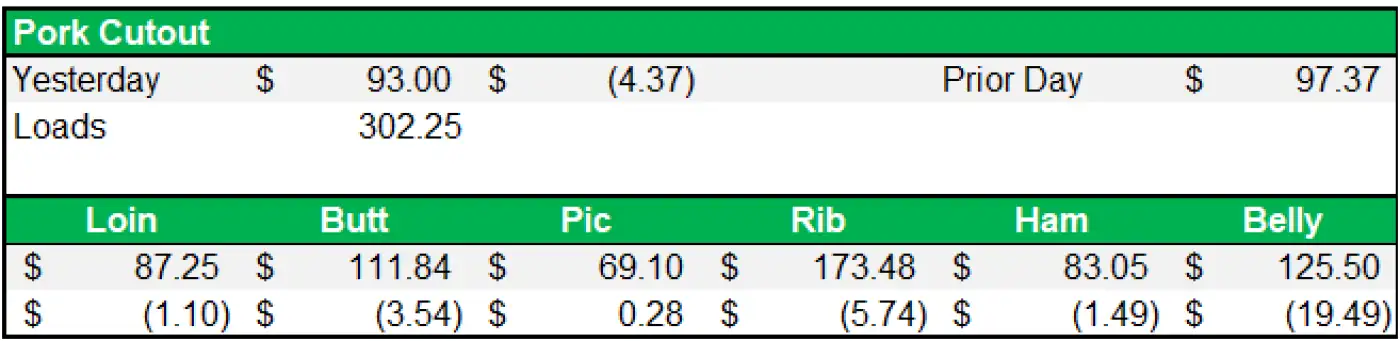

- Cutout had a tough day well which may helped each future contract to pull back to end the trading session.

February’26 Hogs

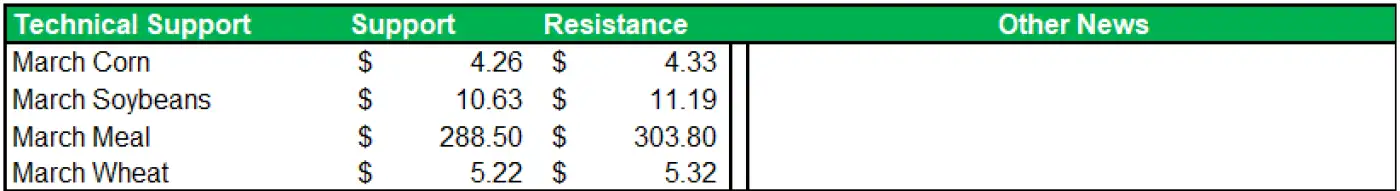

Grain

- On the overnight soybeans are up 8, corn is unch, s and p 500 is down 40 points, silver is down 8 and gold is down 70 points.

- Soybeans led the grain after President Trump released a Truth Social post saying China will consider buying up to 20 MMT of beans this marketing year after buying 12 MMT.

- March beans at one time traded up to 49 cents higher and ended the day up 26 ½.

- It is interesting the time this comes as Brazil is starting their harvest and normally China will stop importing beans from the US until our harvest. Makes you questions Why would they buy beans from the U.S., when one Brazil’s are cheaper and logistically easier to buy from Brazil this time of year.

- Despite the strength in beans corn only finished up a penny. This might tell us how hard a rally this corn market is going to have to work for a rally.

March’26 Corn

March'26 Soybeans

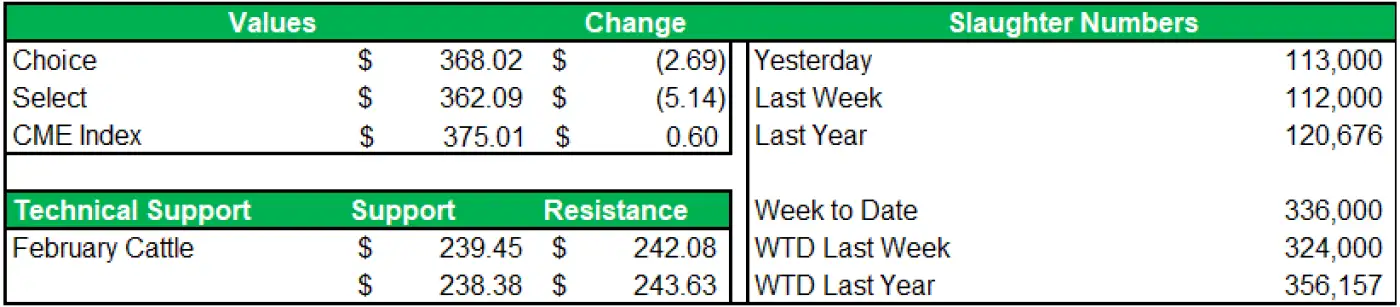

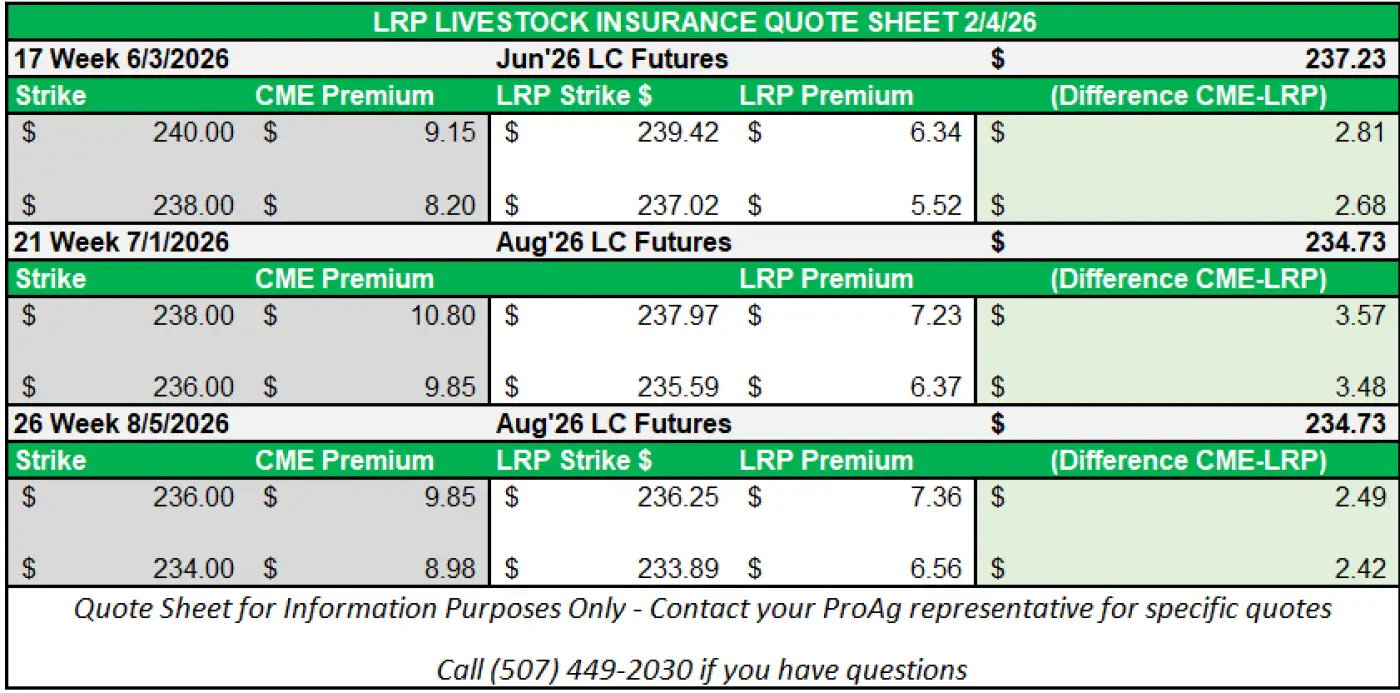

Cattle

- Yesterday the cattle market ended slightly higher, even though it backed off the strong early gains once soybeans and corn pushed higher mid‑morning.

- The sharp drop in tech stocks also seemed to contribute to the pullback with the S & P 500 having large losses, but the technical tone for the week was still very strong and pointed toward more upside. Feeders continued to lead the market higher, and feeder auctions earlier in the week were also stronger.

- Slaughter levels had been running well below average for the past couple of weeks, and it looked like that trend would continue, which likely meant packers would need to pay up again for cash cattle. As of yesterday, USDA still hadn’t reported any cash trade for the week.

February’26 Cattle

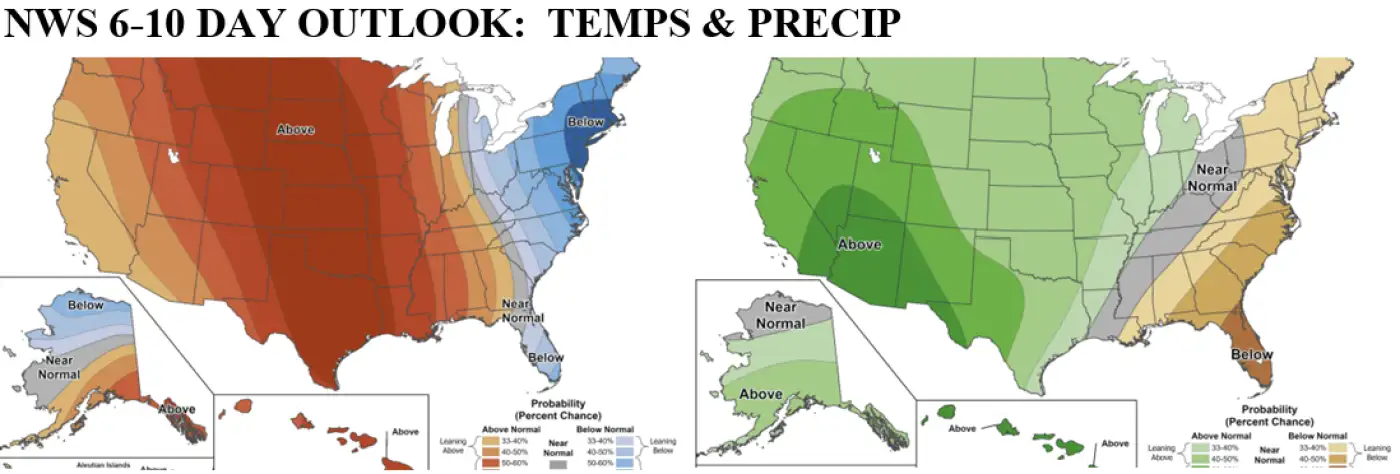

Weather

- The Plains and Midwest remain dry this week with extended precipitation maps finally showing action creeping in from the west, with a wetter north/ northwest and drier south/southeast pattern through mid-month. Temperatures continue to heat up this week, above-normal thru mid-February as well.

- Argentina was dry over the past 24 hours and mostly dry going forward as well, though a rain chance moves in today through Friday; the best chances will occur center-north but all areas will see at least some precip chance.

- Brazilian rain fell in the northeastern half or so of crop areas yesterday and chances favor the center-north over the next week to ten days; some better scattered southern rains are possible in today’s ten-day forecast.