DMC

August 26, 2025

Categories:

DMC

Hogs

- Lean hogs were able to hold slight gains to begin the week, with a very narrow trading range. Some uncertain about demand as we move the calendar ahead.

- Cutout saw overall gains with a mix in the cuts. Pic and hams saw some strength, while bellies moved lower. Retail segments seeing less bacon demand as summer draws to its close.

- Cash was lower as we began the week with the national down 69 cents. Packers are anticipated to be more aggressive today as it is Tuesday ahead of a holiday on Monday.

- Another light slaughter day on Monday down 5% from last Monday’s kill. Tight slaughter over the past several weeks continues, likely benefiting cutout values.

- Last week’s slaughter was revised downward by 9,000 to 2.410 million head, 3.9% below the year prior. Early projections for Saturday's slaughter range from 15,000 to 20,000 head. The week's total is estimated near 2.370 to 2.375 million head. Packers processed 2.428 million head during this week last year.

- British shop prices rose this month by the most since March last year, potentially adding to the Bank of England's worries about how long the country's high inflation problem is likely to last. Shop prices rose by 0.9% compared with August 2024, driven by a jump of 4.2% in food prices, the biggest since February last year, the British Retail Consortium said on Tuesday.

Grains

- Dec corn down half a penny. November beans are up 5 3/4. The equities are lower. Gold is higher, and copper is lower.

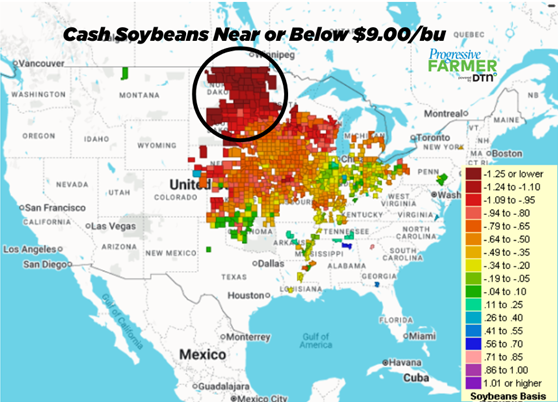

- The ongoing trade dispute with China continues to weigh heavily on U.S. soybean demand and basis values. The absence of Chinese purchases for new-crop soybeans is hitting Northern Plains producers particularly hard, as their supplies would normally move through local elevators to the Pacific Northwest (PNW) for export. With no basis being posted for PNW shipments, elevators that rely on that flow have sharply lowered bids. Consequently, basis levels in several states are historically weak—some at their lowest point since the 2018 trade conflict. Additional pressure looms with the USTR-301 China vessel fee program set to take effect in mid-October, prompting global shippers to reroute and reschedule in anticipation of higher U.S. port costs.

- Last night Nov beans tested that $10.40 spot but couldn’t break through as we are back above $10.50 this morning. It will be interesting to see what soybeans decide to do today.

- U.S. corn crop ratings held firm last week, with 71% of the crop rated good to excellent as of Sunday—unchanged from the prior week and well above the five-year average of 60%. This marks the second-strongest rating for the week in the past decade, behind only 2016. USDA also reported that 7% of the crop has reached maturity, compared with 3% a week ago and in line with the five-year average of 7%. Soybean conditions ticked slightly higher, with 69% rated good to excellent, up from 68% last week and well above the 61% five-year average. That rating is the best for this week since 2020.

Cattle

- Cattle futures began the day on Monday trading lower. The lower tone seemed to fade quickly with cattle able to make gains for the day.

- Media reports continued reporting on the New World screwworm which entered the U.S. on a human traveling from El Salvador. This likely influenced the market and will continue to keep a more cautious trade. This likely makes one question the length of the Mexican-U.S. border cattle closure.

- Cutout was again higher with choice up 58 cents currently at $408.49. Packer margins have seen huge improvement thanks to last week’s big rally.

- Packers will be buying this week for next week’s holiday shortened week. Meat supplies will remain in short supply and show lists are smaller in all regions. Trading is expected to be delayed until last week and very little framework was established at the beginning of the week to provide information about the cash markets.

Weather

- Rainfall over the past 24 hours was largely limited to Oklahoma and nearby areas, while most of the Midwest remained dry. Precipitation continues to stay focused in the southwest for now, with heavier totals and broader coverage expected across the Plains and into the southern U.S. Extended outlooks are mixed: the NWS 6–10 day and 8–14 day forecasts suggest above-normal rainfall returning to the core of the Corn Belt, while other models keep the wetter pattern confined to the far west and southwest into early September. Temperatures are projected to stay comfortably below normal for the next two

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.