DMC

September 2, 2025

Categories:

DMC

- Lean hog futures had a positive week last week with the October futures climbing over $3.80.

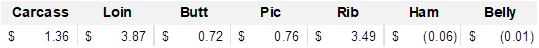

- Futures were supported by a positive cutout for the week up $1.36. While cutout values started the week off slow, higher prices finished the week off, which is a true positive for this time of the year.

- The national posted $3.28 lower on Friday. Slaughter came in at 2,391,000 for the week down slightly from prior week and prior year.

- Cash isowean pig prices averaged $56.78 for the week ending 8/29, up slightly from week prior $56.25, and up from $31.07 last year at this time.

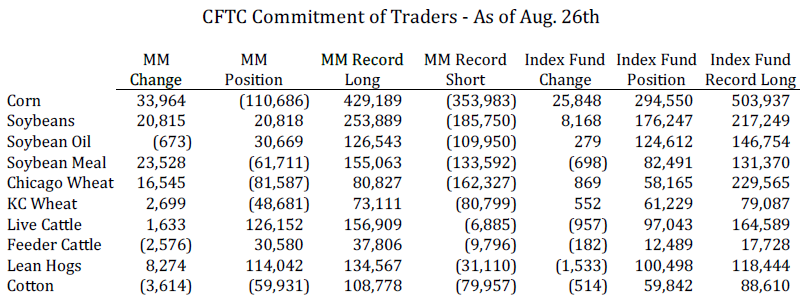

- Speculative traders grew net long positions in lean hog futures by 8,274 contracts, reaching a net long of 114,042 contracts, adding to the bullish sentiment.

- Mexico: Pork production breaks record with more than 900,000 tons in the first half of the year. At the end of the first half of 2025, pork production totaled 921,226 tons (t), representing a 5.5% increase over the same period in 2024.

Grains

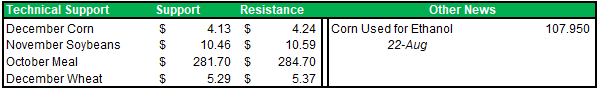

- Dec corn is down 3 1/4. Nov beans down 13 1/2 cents. Equities are down sharply, and crude oil is higher.

- Corn and soybean futures strengthened on Friday. December 2025 corn climbed about 10 cents, closing near $4.20 per bushel, marking its largest single-day gain since July 2. The move was fueled by robust export demand and mounting concerns over tar spot and southern rust across the Corn Belt. Soybeans also posted gains, with the November 2025 contract up roughly 7 cents to finish around $10.55. Support in the soybean market stemmed from renewed optimism that a trade deal with China could reopen U.S. sales, though no agreement has yet been finalized.

- Interesting action in the commitment of traders data, Covered some shorts up on the corn side of things, and soybeans increased their long.

- Soybeans are trading lower on the over night, will be interesting to see if we can hold that $10.40 spot on the Nov contract.

Cattle

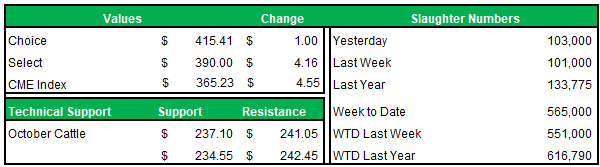

- Cattle futures saw a good week last week with futures climbing near $2 higher.

- Support was seen in the cutout which had choice gaining $7.50 for the week, and select gaining $6.34. Friday saw cutout values up $1 in the choice. It’s generally expected that wholesale beef prices will decline seasonally post-Labor Day.

- Slaughter was up slightly from last week’s pace. This week will be short one day due to the holiday past. Last week closed with mostly steady prices in the north and $2 higher prices in the south. Live sales in the south were mainly $241-2 and in the north $245 narrowing the spread between the two regions. Dressed sales were mainly $385 in Nebraska and higher in Iowa up to $392.

- Managed money increased their long live cattle positions last week by 1,278 contracts, totaling 121,767 contracts. In contrast, they decreased their long feeder cattle contracts by 2,421, taking them down to a total of 30,426 contracts.

Weather

- Showers developed across the Plains and western Corn Belt over the holiday weekend, while the central and eastern Corn Belt remained mostly dry. Light rainfall is expected to move through the northeast belt by mid-week and into the southern Midwest heading into the weekend. The 6–10 day outlook stays largely dry, but precipitation chances improve again in the 11–15 day window, particularly across the western Corn Belt. Temperatures will run below normal through the next ten days before returning closer to seasonal levels by mid-September.

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.