DMC

September 8, 2025

Categories:

DMC

Hogs

- Lean hog futures had a strong week closing higher for the week. October closed above $96 not quite making a new contract high. Both current supply and demand has been supportive.

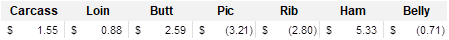

Cutout closed the week higher by $1.55. Friday had a strong day with cutout up $2.55, strength this week was seen in a variety of cuts, with the exception of pic and ribs.

- On September 5, 2025, the Chinese Ministry of Commerce announced the imposition of provisional anti-dumping duties on pork and pork by-products from the European Union, with rates ranging from 15.6% to 62.4%. The measure will come into force on September 10 and affects trade valued at more than 2 billion dollars annually.

- The Commitment of Traders report showed the fund traders adding 10,270 futures contracts of hogs, bringing their net-long position to 119,336 contracts.

Grains

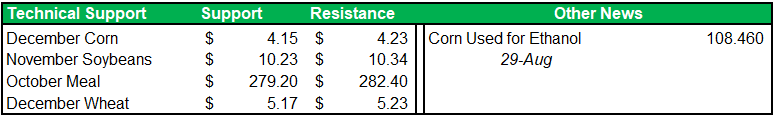

- Dec corn is down 2 cents. Nov beans up 1 1/4. Equities are higher, and crude oil is higher. Gold is lower.

- Freezing temperatures touched parts of the U.S. Corn Belt over the weekend, with lows dipping below 32°F early Sunday across portions of North Dakota, South Dakota, Minnesota, and western Nebraska. The extent of crop damage remains uncertain. Despite the potential risks, the market opened the week with little reaction, as trade remains largely subdued.

- On Friday, the USDA confirmed two flash sales. U.S. exporters booked 327,650 metric tons (12 million bushels) of soybeans to unknown destinations for 2025/26 delivery. Even with this activity, total accumulated sales for the 2025/26 marketing year remain 32% below last year’s pace.

- US job growth slowed in August as the unemployment rate ticked higher. The Labor Department reported on Friday that the economy added just 22,000 jobs last month, well below expectations of 75,000. Unemployment rose to 4.3% from 4.2% in July, the highest since October 2021. June’s figures were also revised lower, now showing a loss of 13,000 jobs, the first monthly decline since 2020.

Cattle

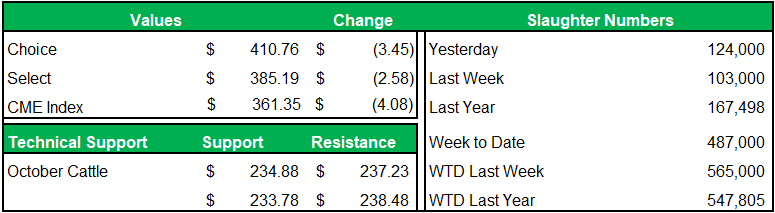

- Live cattle futures moved lower on Friday.

- The Commitment of Traders report showed the fund traders adding 4,763 futures contracts last week in live cattle, bringing their net-long position to 126,530 contracts. Fund traders reduced their net-long position in feeder cattle by 2,782 contracts to 27,644.

- Cutout moved lower on Friday with choice down $3.45. Week over week choice was down $4.65 and select -$4.81.

- Cattle sold in both areas at $242-$243 — one higher in the south and two lower in the north. Dressed prices were mainly $383 in the north also two dollar lower.

- Texas beef plants will struggle to acquire inventory in the coming months leaving Kansas plants to look north for fed supplies to supplement Kansas feedlot supplies. Texas cattle on feed numbers on August 1 were the lowest since 2014 and 2015, when numbers were at their tightest of the last cattle cycle. Because of the dependance of Texas on Mexican feeder cattle supplies, on feed numbers in Texas likely will drop further.

- Everyone expects this week’s slaughter to push up over 560k to 570k head. It’s anticipated that a larger production schedule will pressure boxed beef values, adding to the short-term bearish vibe.

Weather

- Weekend rains were confined to the southern U.S. with the bulk of the Midwest dry; action looks fairly light and isolated this week as well, with some chances in the SW belt today and the NW belt later in the week. Extended maps continue to bring in above-normal rains to the NW belt and northern Plains, expanding a bit in the west into the 11-15 day, while the central and ECB stay dry. Temperatures will be on the rise this week, holding safely above-normal through mid-month and now into late September.

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.