DMC

August 11, 2025

Categories:

DMC

Hogs

- Lean hog futures closed mixed on Friday as competing proteins likely added pressure to the market.

- Packers were less aggressive looking to acquire inventory on Friday pushing the national cash price down $4.49 for the day. National prices last year came in at $84.87, Friday posting $106.73.

- Cutout was higher on Friday with gains in all but the hams. This put week to date cutout plus 47 cents on the week:

- Cash isowean prices for the week ending 8/8/25 averaged $53.66 down slightly from last week’s $5419, but up from last year’s $26.88.

- The Commitment of Traders report showed fund traders reducing their long position by 624 contracts to a net long of 104,129.

- Last week’s slaughter estimated at 2,350 down from last year by over 1%. Prices are expected to start the week with a steady tone, while prices seasonally decline here.

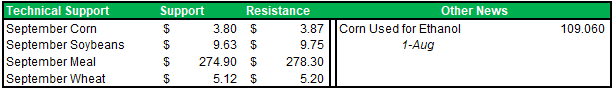

Grains

- Grains are higher. Soybeans sharply. Trump tweeted on Truth that “China is worried about soybean shortage. US great farmers produce he most robust soybeans, He hopes China will quickly quadruple its soybean orders. This is also a way of substantially reducing China trade deficit with US. Rapid service will be provided. Thank you President XI”.

- Corn, soybean, and wheat futures markets fell Friday and ended the week lower. Traders concluded the week by fading the upcoming USDA Supply/Demand and WASDE reports, which are scheduled to be released Tuesday.

- New forecasts call for little rain in the Corn Belt for the next 15 days.

- On Friday Managed funds were even Chicago wheat and soymeal and sold 1,000 corn, 3,000 soybeans and 5,000 soyoil. Managed funds sold soybeans, soyoil and wheat last week. We now estimate Managed funds to be short 82,000 Chicago wheat, 134,000 soymeal, 178,000 corn and 81,000 soybeans and long 44,000 soyoil.

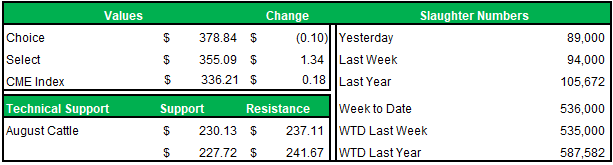

Cattle

- Cattle futures took back on Friday a technically overbought market. Higher cash cattle was anticipated yet did not follow through. Feeders had rallied all week with an index much lower than current futures.

- Feeder cattle futures were locked limit down in August through May contracts, with live cattle limit down in the October contract. The result is that expanded limits are in effect today.

- Another small week in slaughter estimates of 536,000 down 8.7% from last year. For the processors, simply cutting the slaughter is not the complete answer because small slaughter volumes are not an efficient use of the plant.

- The Commitment of Traders report showed fund traders as net sellers of 3,479 futures contracts in live cattle, reducing their longs to 121,467. Funds were net buyers of 1,939 contracts in feeder cattle, increasing their long position to 35,979.

- Crashing futures set the stage for steady to weak prices for fed cattle. In the south most sales were at $235 following earlier bids and light trade at $237. In the north live trade was $242-$245 — steady to weak. Dressed prices ranged from $380-$385 — also weak to lower.

- Cutout was mixed on Friday. Week to date choice gained $15.62. Boxed beef values are rallying now, which is also normal seasonally and losses are lessening.

weather

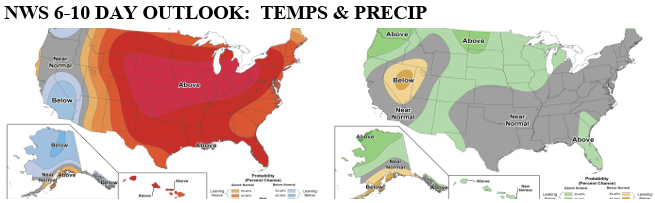

- Weekend rains were heavy from southwest to northeast across the Midwest, moving east/southeast across the belt through mid-week before more precip fires up in the northern belt late week. Wet forecasts linger through the 6-10 day period, with 11-15 day maps trending a bit drier. Temperatures are safely set in the above-normal range for the next ten days, closer to normal after that..

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.