DMC

August 13, 2025

Categories:

DMC

Hogs

- Lean hog future struggled to find support on Tuesday, even against climbing cattle futures. August through May closed lower, while Jun’26 and beyond closed higher.

- Cutout did not lend support closing $4.39 lower with decreases in all but the rib as limited trade was found in the market.

- Week to date slaughter running slightly below last year. Saturday slaughter estimates are around 35-40,000 head. This would show slaughter continuing its recent pace of lower than year ago levels. National pig prices climbed $4.16 for the day Market outlook today is expected to be steady to slightly firmer. National prices are around 35% above last year, packers indicate a tighter supply.

- U.S. consumer prices increased moderately in July, though rising costs for goods because of import tariffs led to a measure of underlying inflation posting its largest gain in six months. The consumer price index rose 0.2% last month after gaining 0.3% in June, the Labor Department's Bureau of Labor Statistics said on Tuesday. In the 12 months through July, the CPI advanced 2.7% after rising 2.7% in June. Economists polled by Reuters had forecast the CPI rising 0.2% and increasing 2.8% year-on-year. Excluding the volatile food and energy components, the CPI rose 0.3%, the biggest gain since January, after climbing 0.2% in June. The so-called core CPI increased 3.1% year-on-year in July after advancing 2.9% in June.

- China has reported 210 confirmed and 795 susceptible cases of African Swine Fever (ASF) in Napo County, in the Sichuan Province, a World Organization for Animal Health (WOAH) report showed.

Grains

- Dec corn is up 2 cents. November beans are up 11 ½. The S&P is up 18 points. Gold is higher, and copper is lower.

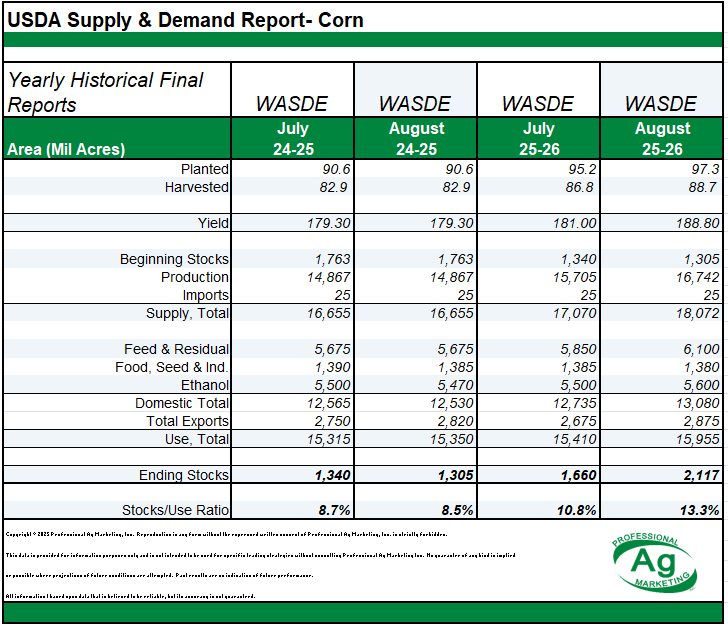

- Yesterday we had a massive report on the August WASDE yesterday. USDA raised their corn yield to 188.8. Yet our ending stocks were only at 2.117 Billion bushels despite having a massive yield. The USDA bumped demand up, on feed and residual, and ethanol grind and also exports. Notably they also bumped the corn acres up a couple million.

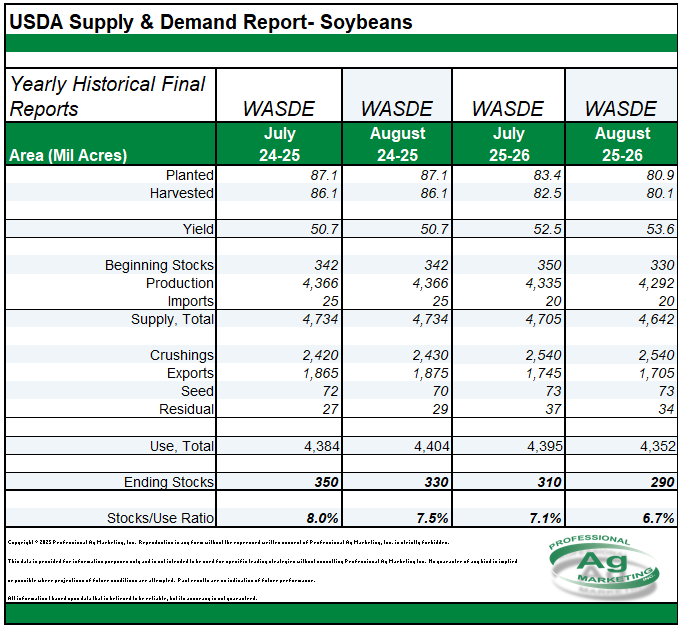

- On the soybean side of things, we came at yield of 53.6 at the top end of trade range. Although we increased yield our ending stocks decreased. With our lack of export progress they decreased exports for 2025/26.

- On Tuesday, the stock market surged after the July CPI report matched expectations. The S&P 500 rose 1.1% and the Nasdaq gained 1.4%, both closing at record highs. Data showed consumer prices increased 0.2% from June and 2.7% year-over-year—meeting monthly projections and coming in slightly below the anticipated 2.8% annual rate. The steady inflation figures led money markets to assign roughly a 90% chance that the Federal Reserve will cut interest rates in September, with speculation building over whether the reduction will be a quarter-point or half-point.

Cattle

- Following Friday’s break, cattle futures have turned and continue to push higher.

- Supporting the market this week has been the cutout. Choice gained another $9.06 on Tuesday, putting the gain so far this week of $11.71. End users are nervous about limited fresh fed beef availability during the last four months of the year and all of 2026. And those who rely on lean grinding material are having to search for lean cuts from wherever the source, even some subprimals from fed cattle.

- The consumer has yet to face a rebalanced sticker price reflecting the input cost of live cattle, but now retailers will look to pass along newly increased pricing of beef cuts. Repricing at the grocery will not happen all at once but instead will occur store by store, firm by firm, at different speeds. Meat counters will continue to feature beef but less product and higher prices.

- Brazilian beef imports into Mexico have surged significantly in 2025, particularly during June and July, marking a pivotal shift in the market landscape. Year-to-date, Mexico’s purchases from Brazil have increased by more than 300% compared to the same months in 2024, rising from 3,666 metric tons(mt) in June 2024 to 16,170 mt in June 2025, and from 4,907 mt in July 2024 to 15,580 mt in July 2025.

- While early thoughts of negotiated prices was weaker to steady it likely has faded as the futures rally.

Weather

- Rains were light and confined to the ECB over the past 24 hours, moving out to the southeastern U.S. today and tomorrow, with chances best in the northern belt through the weekend. The same warm and wet pattern continues into the 6-10 day, closer to normal for both temps & precip heading into late Aug.

About the Author

Rob Andringa

Rob grew up in the heart of agriculture along with 15 years of experience in the livestock and feed industry. Helping producers manage inputs and livestock unique to each client’s business is exciting to him.